Chart of Accounts Example Format Structured Template Definition

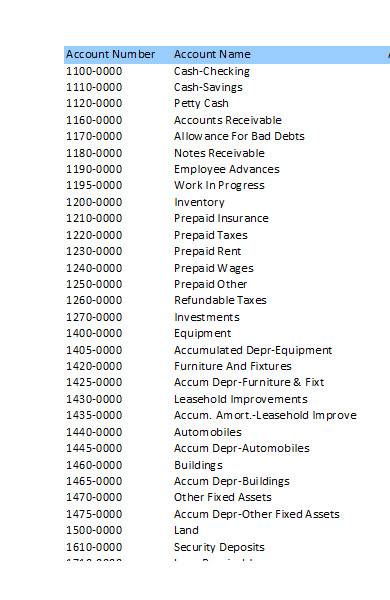

Knowing how to keep your company’s chart organized can make it easier for you to access financial information. Decide on the account categories you want to include in your chart of accounts. Typically, businesses use a standard set of categories, such as assets, liabilities, equity, income, and expenses. The COA is usually hierarchical, with accounts organized in categories and subcategories. These categories include assets, liabilities, equity, revenue, and expenses.

Is There a Single COA Format?

To ensure you start out on the right foot, we’re providing you with a COA template to download and customize to your heart’s content. Imagine someone plops you down into the middle of a massive city and asks you to find a particular address. Even if you know that city fairly well, without a GPS or map to direct you, you’re either going to spend an awfully long time finding that address or not find it at all.

Major Types Of Chart Of Accounts

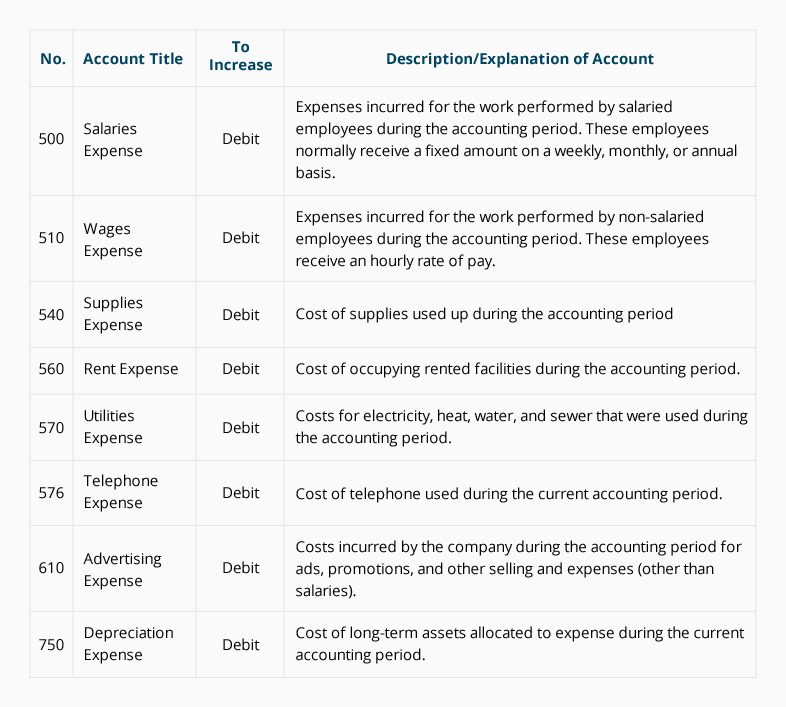

Larger businesses might also need more detailed categories or sub-categories to accommodate diverse transactions and departments. For example, many accounts that are essential in manufacturing are not commonly used by retail businesses, including the composition of cost of goods sold (COGS). Therefore, when crafting a chart of accounts, always consider the tax legislation, financial reporting standards, government regulations and other compliance requirements relevant in your circumstances. So, separating these additional accounts allows businesses to understand the specific drivers of their financial performance in more detail. Operating expenses are the costs needed to run a business day-to-day, for example, rent and salaries.

How is a COA grouped for reporting purposes?

A well-designed chart of accounts should separate out all the company’s most important accounts, and make it easy to figure out which transactions get recorded in which account. Every time you record a business transaction—a new bank loan, an invoice from one of your clients, a laptop for the office—you have to record it in the right account. Below, we’ll go over what the accounting chart of accounts is, what it looks like, and why it’s so important for your business.

Marshall Hargrave is a financial writer with over 15 years of expertise spanning the finance and investing fields. He has experience as an editor for Investopedia and has worked with the likes of the Consumer Bankers Association and National Venture Capital Association. Marshall is a former Securities & Exchange Commission-registered investment adviser and holds a Bachelor’s degree in finance from Appalachian State University. These numbers are typically four digits, and each account has a unique number.

- The only difference is that today, you don’t need pen and paper (or quill and paper, though I like that idea) and use accounting software (or any other electronic means of accounting) to do your books.

- Accounting software can facilitate standardization, providing pre-defined templates that align with generally accepted accounting principles (GAAP).

- Avoid creating too many specific accounts initially; instead, add them as your business needs evolve.

- My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers.

- As mentioned, besides the standard five accounts, the chart of accounts may contain additional accounts, created for the sake of more granularity or to cater to a business’s particular needs.

In order to keep the number of accounts down to a manageable level, you may periodically review the list and close any accounts that are not fully utilized. On one hand, keeping the number of accounts to a minimum will make the accounting system more straightforward to use. It also helps managers plan budgets and see which business areas are making money and which might need extra attention.

Yes, each business should have its own Chart of Accounts that outlines the specific account categories and numbers relevant to their operations. Just remember that while you can add an account to the chart at any time throughout the financial year, you should not delete any accounts until the end of an accounting period. Therefore, it is advisable to initially create a list of accounts that is unlikely to significantly change for as long as possible and keep it congruent among all areas of business.

Current liabilities are any outstanding payments that are due within the year, while non-current or long-term liabilities are payments due more than a year from the date of the report. But ultimately, how effective it is in informing best payroll software 2021 your decision-makers and ensuring an efficient record-to-report process is up to you. So take our template, along with the many insights and tips we’ve discussed, and build a COA that drives real success for your organization.